How to keep track of money

Getting your family's

monthly bills organized and paid is a chore that everyone in America

goes through month after month. Ultimately a lot of families are also

trying to budget their monthly bills as well as just paying them. The

2007 -2011 recession has hit middle income families hard. Budgeting has

become a serious issue during this current recession. Middle income

families just don't and can't spend money like they used to.

How to keep track of money

is one of the very first steps that need to be taken if you are to get

your family's monthly bills under control. Modern middle income families

don't carry a lot of cash on them; today's family is more likely to have

bank debit cards and their favorite "rewards" credit card to make

purchases.

This move towards plastic has brought

very good tracking mechanisms that try to help you keep an eye on your

money. Unlike cash that you need to keep a receipt to know where the

money has gone, plastic immediately records exactly what was spent and

where.

Lovely except....

Keeping track of money has

gotten harder since we moved from cash to plastic simply for the fact

there are more ways to pay for everyday items. Now instead of reaching

into your wallet and paying for your meal at Subway you use your debit

card, when you go to J.C.Penney's you use your Penney's card. So at the

end of the month you have bills coming at you from at least 10 different

directions. It becomes real easy to loose track of the money.

Here are a couple of rules

to follow when trying to keep track of your money:

- Keeping track of money is all about creating a

record of the purchase, and being able to decipher what that

purchase was when you sit down to categorize and calculate your

monthly bills on a

family budget worksheet or a software program like Quicken

or Peachtree.

- Carry one main form of payment with you. Your

bank's debit card is the obvious choice but if you want to use a

credit card that gives you "rewards" then that will be fine. Cash is

also fine however if you choose the cash method you will need to also

keep all of the receipts.

- Don't worry if when you hear "debit" or "credit"

from your local merchant. The only difference for you is when the

money "posts" or comes out of your account. A debit charge

will post immediately a credit charge will normally post the very

next day. I typically ask the merchant which is cheaper for them

debit or credit since they are paying fees.

- Stop using store credit cards. In our BillsOnly

opinion, in the beginning moments of getting your family's monthly

bills under control, it is far more important to know how much is being

spent vs. getting an additional 10% off for using that particular

credit card.

- Carry one check in your wallet for an emergency.

I can't tell you how many times I have tried to purchase something

and the credit card machine is down. If you don't have cash write a

check.

- The cash in your wallet is for emergencies

as well. Don't pay for that lunch with cash, use your main form of

payment. I know this sounds counter productive to budgeting and

spending only what you have, but right now your family's monthly

bills are out of control and you need to learn how to keep track of

the money you have or think you have.

- Try to group purchases together. Example if you

are buying a $20 birthday present for someone don't add that $20

shirt that you need to this particular charge. Buy the present then

buy the shirt. Don't purchase them together. When you finally get

around to categorizing all of your monthly purchases it will look

like you bought a $40 present when it really was only $20.

All of the rules

above are just meant to help you quickly retrieve a record from your

online bank statement or from your main credit card. The object is

that 90% of all of your monthly charges show up in one place. That

is why BillsOnly prefers debit cards vs. credit cards. Debit cards

show up in your bank statement which is just flat out easier to find.

Now that we know

where we can locate what we spent during the month the next step is

to use some form of a family budget worksheet to keep track of the

money. This is actually the simple part. The staff at BillsOnly

still likes software programs that download the date from the bank

statement but we realize that not everyone wants to keep up with

another program. We created a free family budget sheet

to help you

with this.

Here's How:

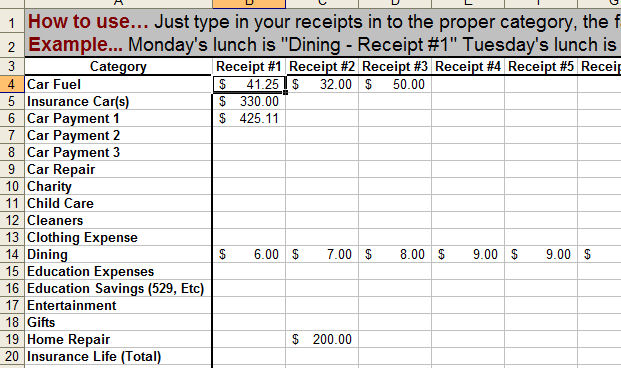

1) Just place your

receipts into each months "entry tab at the bottom of the family

budget sheet. Each month has both a total tab and bill entry tab.

Click on the tab.

Start entering in the

information by receipts. The spreadsheet will do all of the math for

you.

Finally, if you enter

all of the information into the monthly entry tabs our family budget

sheet will not only calculate monthly bills it will also roll up to

total yearly bills and average bills per month as well.

Use a family budget

sheet to keep track of your money. Here is our new advance worksheet

ready to be downloaded in an excel format.

Click here for the advanced

family budget sheet.

|